Using Implied Volatility to Time Options Trades

Implied volatility (IV) is one of the most important factors in options pricing. Yet many traders ignore it when deciding when to enter or exit trades. Mastering IV can help you avoid overpaying for options and improve your timing—whether you’re a buyer or a seller.

This post breaks down what implied volatility is, how it works, and how to use it to time your options trades more effectively.

What Is Implied Volatility?

Implied volatility is the market’s expectation of how much a stock will move in the future. It’s expressed as a percentage and is built into the price of options.

Higher IV = higher expected movement

Lower IV = lower expected movement

IV doesn’t tell you direction—only the magnitude of expected movement.

How IV Affects Option Prices

- High IV = expensive options (good for sellers)

- Low IV = cheap options (good for buyers)

This happens because options pricing models (like Black-Scholes) include IV as a key input.

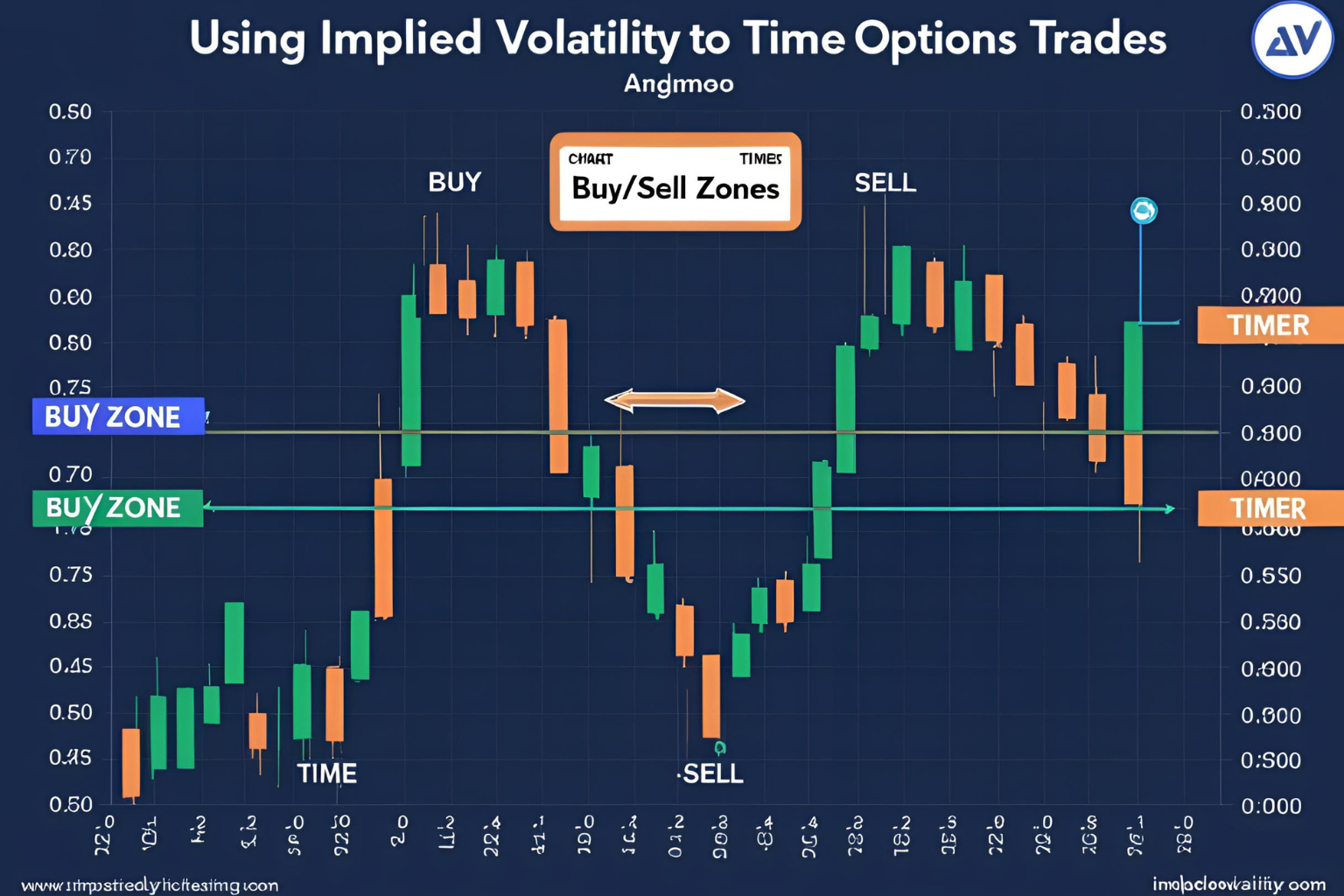

When to Buy or Sell Based on IV

| Action | IV Condition | Reason |

|---|---|---|

| Buy options | IV is low | Options are underpriced |

| Sell options | IV is high | Options are overpriced (collect premium) |

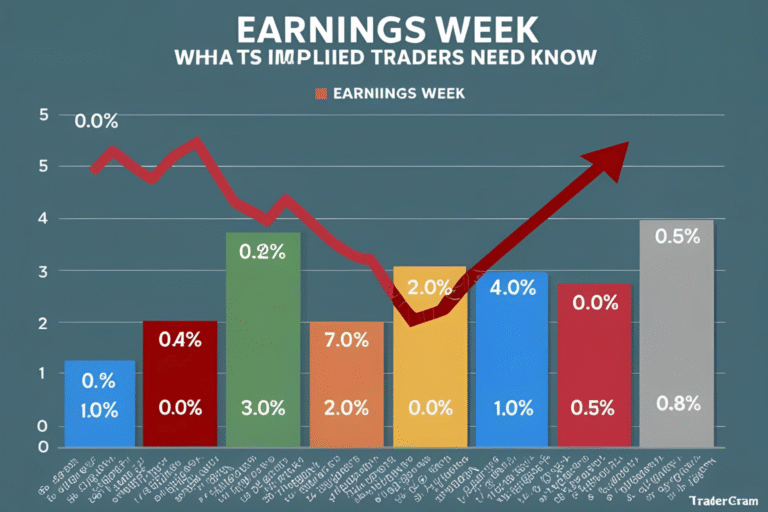

IV Crush: A Trader’s Trap

An IV crush happens when implied volatility drops sharply—often right after earnings or major news. If you buy options before a big event, and the stock doesn’t move enough, IV can fall and crush your option’s value—even if you’re right on direction.

Tip: Sell options before events if IV is elevated.

Tools to Measure Implied Volatility

- IV Rank: Shows current IV level compared to the past year

- IV Percentile: Shows where current IV stands among recent values

- Thinkorswim, TradingView, OptionsPlay: Offer built-in IV analysis

Example: Using IV for Better Timing

You’re bullish on ABC stock, trading at $100.

- IV Rank is 10% → options are cheap

- You buy a $105 call for $1

If ABC rises and IV increases to 30%, your option gains from both price move and IV expansion.

FAQs

1. What is implied volatility in options trading?

It’s the market’s estimate of how volatile a stock will be in the future.

2. Should I avoid buying options when IV is high?

Yes, unless you expect even higher volatility or are using a specific strategy like a straddle.

3. What is IV crush?

A sudden drop in implied volatility that reduces option value—common after news events.

4. Can I trade options using only IV signals?

No, IV should be used with technical and fundamental analysis for best results.

5. Where can I check implied volatility?

Most options platforms like Thinkorswim, Tastyworks, or TradingView display IV data.