How Earnings Season Affects Options Prices: What Traders Need to Know

Earnings season can be exciting—and risky—for options traders. During these times, stock prices often swing sharply. But even if the stock doesn’t move much, implied volatility (IV) changes can significantly affect your option’s value.

This post explains how earnings season affects options pricing and provides tips to trade smarter during these volatile periods.

Why Options Prices React During Earnings Season

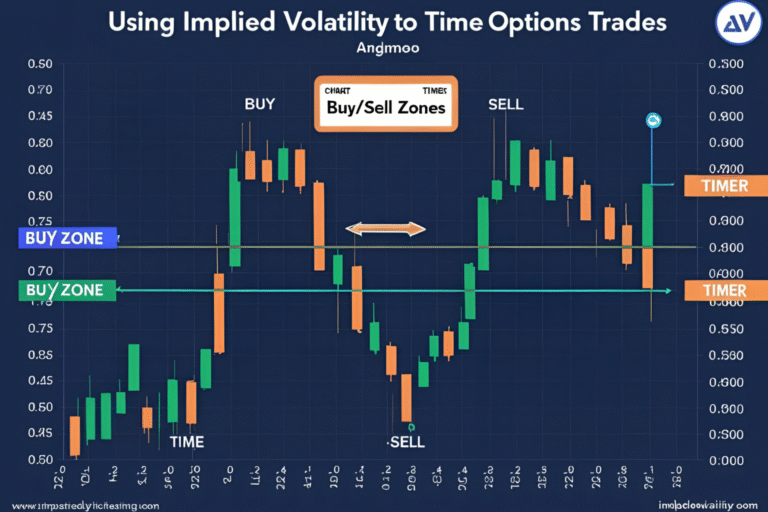

Earnings reports create uncertainty. Traders price that risk into options using higher implied volatility. As the report date nears, IV often rises—making options more expensive.

Once the earnings are released, that uncertainty disappears—and IV often drops quickly, causing an IV crush.

Key Concepts to Understand

- Pre-Earnings IV Spike: Traders anticipate a big move and drive up option premiums.

- Post-Earnings IV Crush: IV collapses, reducing option value, especially for buyers.

- Price Movement vs. Expected Move: Actual stock movement must exceed what the option market priced in to be profitable.

Example: How IV Crush Works

Stock XYZ is trading at $100. The market expects a $5 move (5%).

You buy a straddle (call + put) for $6 total.

- If XYZ moves only $3, both options lose value.

- Even if XYZ moves $5, IV drops post-earnings, reducing potential profit.

- To win, the stock must move more than the expected move + premiums.

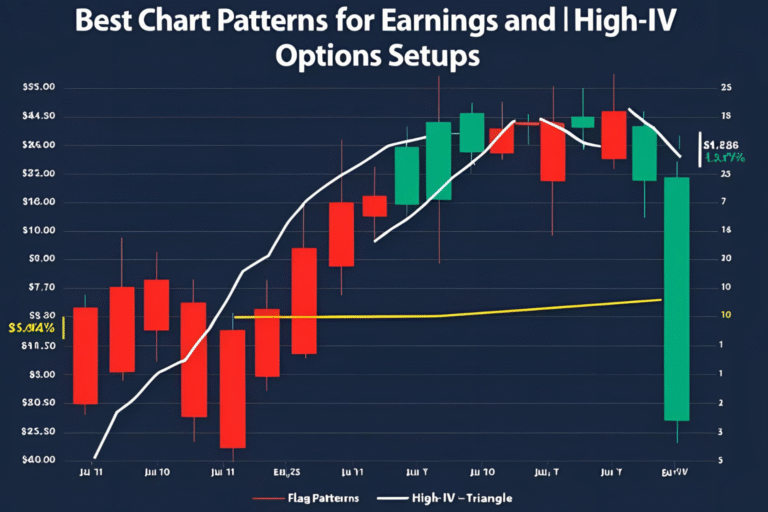

Best Options Strategies During Earnings Season

| Strategy | When to Use |

|---|---|

| Straddle/Strangle | Expecting a big move, unsure of direction |

| Iron Condor | Expecting no big move, IV is high |

| Call/Put Buying | Expecting strong directional surprise |

| Sell Premium | For advanced traders during high IV |

Pro Tips for Earnings Trading

- Check the expected move from the options chain

- Use IV Rank to see if volatility is inflated

- Close trades before the report if you’re an option seller

- Size your position small—earnings are unpredictable

FAQs

1. How does earnings season affect options pricing?

It increases implied volatility, which makes options more expensive leading up to earnings.

2. What is an IV crush after earnings?

A sharp drop in implied volatility once earnings are released—often hurting option buyers.

3. Should I trade earnings with options?

Only if you’re comfortable with risk. Use defined-risk strategies like spreads or iron condors.

4. What is the best options strategy for earnings?

That depends on your market view. Straddles for big moves, condors for small moves.

5. Can I sell options during earnings?

Yes, but it’s risky. Selling when IV is high can be profitable if the stock stays within range.