Options Trading Before and After News Events: What to Expect

News events like Fed announcements, economic data releases, or geopolitical headlines can move markets in seconds. Options traders need to understand how to adjust their approach before and after these events to avoid costly mistakes and capitalize on big moves.

In this post, we’ll explore how news impacts options pricing and which strategies to consider.

Why News Events Matter for Options Traders

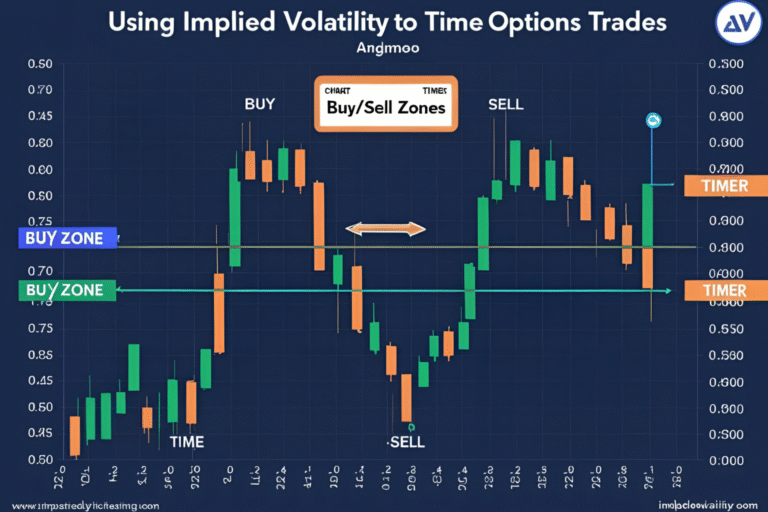

News drives volatility, and volatility drives options pricing. Leading up to a major news event, traders price in the expected risk by bidding up option premiums. After the news, volatility usually drops—known as an IV crush.

What Happens Before News Events?

- Implied volatility increases → Options become expensive

- Traders expect large price swings

- Direction is unknown, but movement is anticipated

Example: Before a Fed interest rate decision, SPY options may trade at higher premiums due to uncertainty.

What Happens After News Events?

- Uncertainty is resolved

- IV drops rapidly

- Options lose value—even if the move is small

- Traders who were wrong on direction lose money quickly

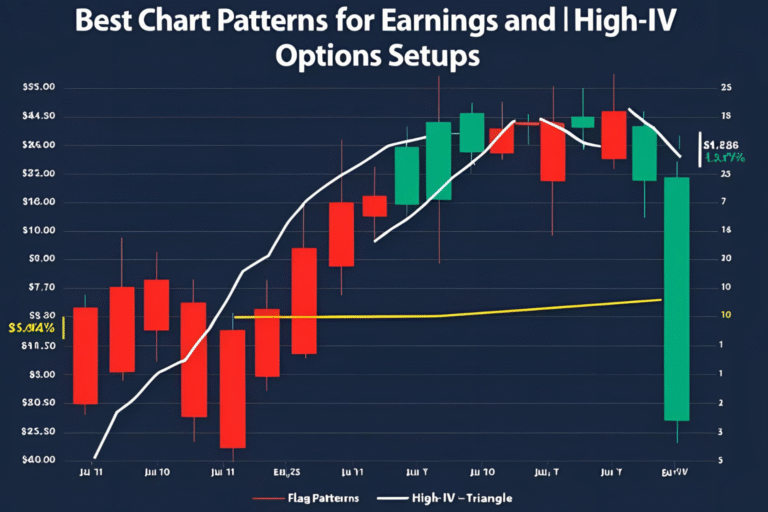

Strategies for Trading Around News Events

| Strategy | When to Use | Why It Works |

|---|---|---|

| Straddle/Strangle | Before big news, unsure of direction | Profit from large move either way |

| Vertical Spreads | Expecting a move but want defined risk | Lowers premium cost, limits losses |

| Iron Condor | Expecting limited movement | Benefits from IV crush, time decay |

| Wait and react | Post-news clarity | Trade direction after confirmation |

Pro Tips

- Always check the economic calendar before trading

- Size positions smaller around high-volatility events

- Use defined-risk strategies when IV is high

- Don’t hold options through news if you don’t understand the risks

FAQs

1. Should I trade options before news events?

Only if you expect large movement and are comfortable with IV risk.

2. What is the best strategy after news is released?

Directional trades like debit spreads work well once the trend is clear.

3. Why do options lose value after news?

The IV drops, reducing premium—especially in neutral or modest moves.

4. Can I buy options right after news breaks?

Yes, but be quick. Most of the move happens within minutes.

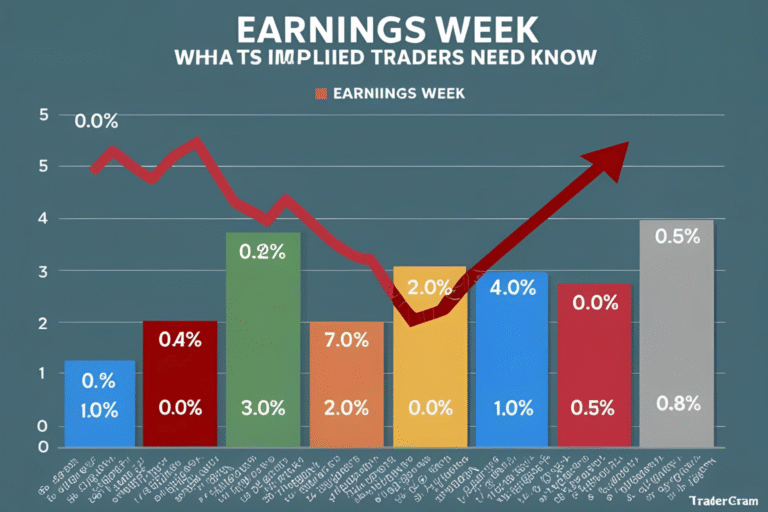

5. What types of news events affect options?

Earnings, Fed meetings, inflation reports, job data, and global headlines.