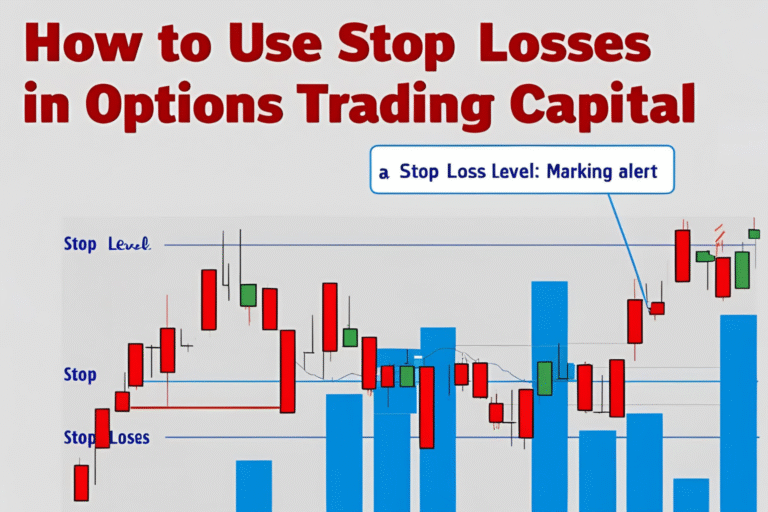

How to Use Stop Losses in Options Trading: Protect Your Capital

Using a stop loss is a key part of managing risk in any form of trading—including options. Since options can lose value quickly due to time decay and volatility, having a clear exit plan is essential. In this post, we’ll explain how to set stop losses in options trading, and when to use them for…