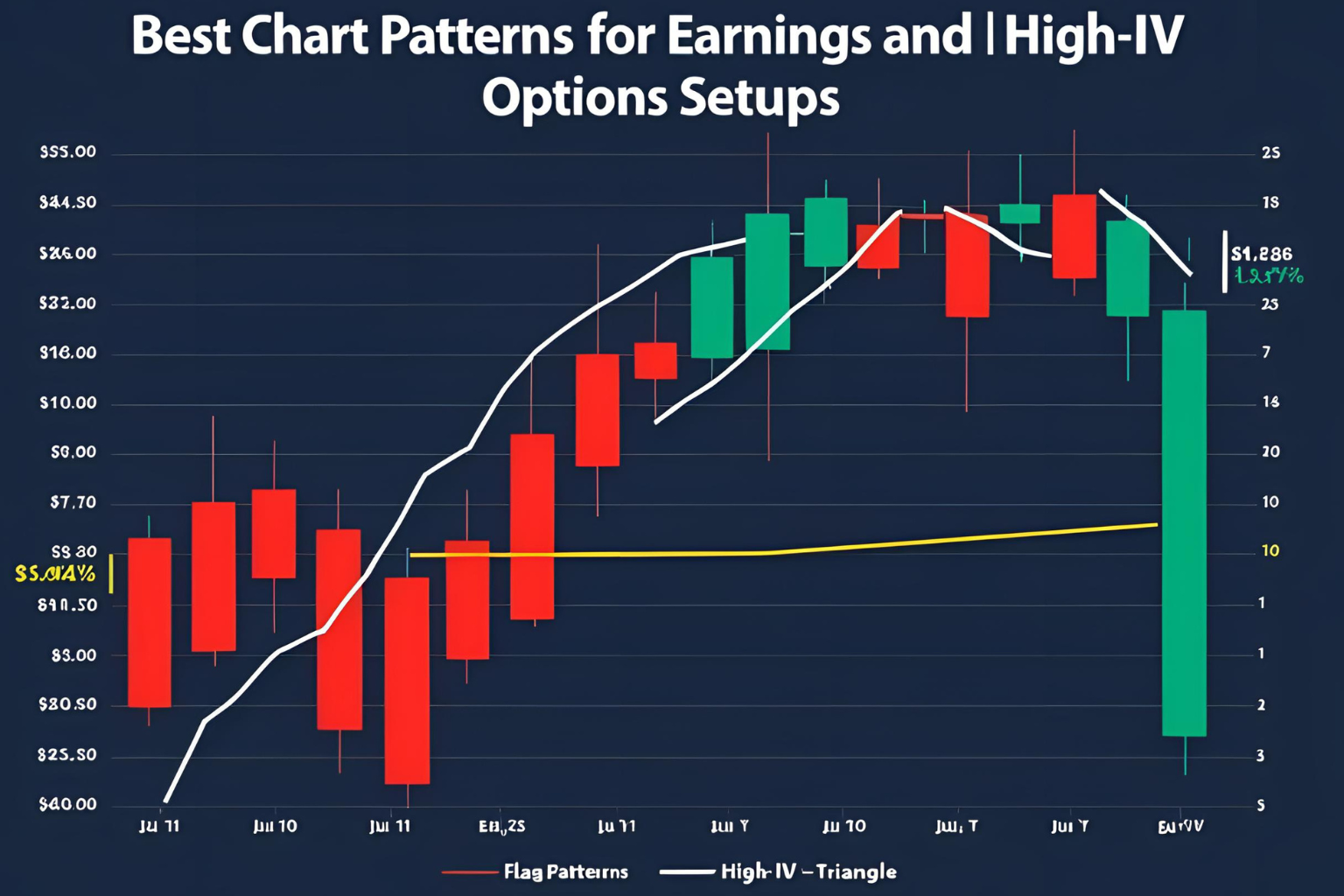

Best Chart Patterns for Earnings and High IV Options Setups

Trading options around earnings season or during periods of high implied volatility (IV) requires precision. Chart patterns can help you identify strong setups, avoid false moves, and plan your trades with greater confidence.

In this guide, we highlight the best chart patterns to use when options premiums are high and earnings catalysts are near.

Why Chart Patterns Matter During High IV

High IV inflates option prices. While this benefits sellers, it also means buyers need sharp timing and clear direction to succeed. Chart patterns help you:

- Spot breakout levels

- Gauge market sentiment

- Enter before explosive moves

- Avoid trades before reversals

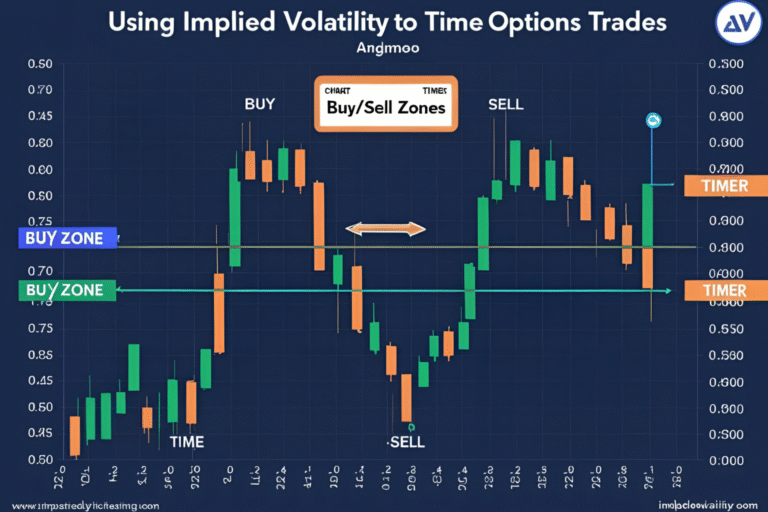

1. Symmetrical Triangles Before Earnings

- Use case: Coiled price action ahead of earnings

- Often leads to explosive moves post-earnings

- Strategy: Straddle or strangle if direction is unclear

Options Tip: Enter before the breakout using low-delta calls/puts, or wait for the earnings gap to confirm direction.

2. Flags and Pennants in High Volatility Stocks

- Use case: Trend continuation after a strong move

- Appears as a small consolidation before the next breakout

- Strategy: Call or put spreads to reduce IV exposure

Options Tip: Combine with IV Rank to see if premiums are overstretched.

3. Double Tops and Double Bottoms Around Earnings

- Use case: Reversal patterns near key levels

- Signals exhaustion and potential price rejection

- Strategy: Vertical spreads or directional puts/calls

Options Tip: Ideal for traders expecting a disappointment or surprise in earnings.

4. Breakout from Consolidation Ranges

- Stocks often trade in tight ranges leading up to earnings

- Breakout direction usually follows strong volume

- Use breakout candles for confirmation

Options Tip: Use debit spreads to reduce the effect of IV crush post-earnings.

5. Gaps and Post-Earnings Flags

- After earnings, watch for continuation or retracement patterns

- Bull flags after upside gaps are common winners

- Bear flags after downside gaps signal continuation

Options Tip: Trade next-day momentum using short-term expiration (0DTE or 2DTE).

Risk Management Tips

- Always define max loss with spreads

- Don’t overpay when IV is at extremes

- Close trades before earnings if premium is your goal

- Set alerts for key levels in chart patterns

FAQs

1. Which chart patterns work best during earnings?

Triangles, flags, and double tops/bottoms are most reliable.

2. Should I trade before or after earnings?

It depends on your strategy. Before = IV premium plays; after = direction confirmation.

3. How does IV affect chart pattern trades?

High IV inflates premiums, so combine patterns with IV analysis for better setups.

4. What timeframe should I use for earnings patterns?

1-hour or daily charts work best for clean signals.

5. Can I trade weekly options with chart patterns?

Yes, especially if your entry is backed by clear structure and timing.