Real-Time Chart Patterns and Options Signals: How to React Fast

In options trading, timing is critical. Reacting to real-time chart patterns can help you catch strong moves before they happen—or exit before things turn against you. Whether you’re swing trading or scalping options, chart patterns combined with options signals can give you an edge.

In this post, we’ll cover how to spot chart patterns as they form and use them to time your options trades effectively.

What Are Real-Time Chart Patterns?

Real-time chart patterns are price formations that develop live on trading platforms. These include:

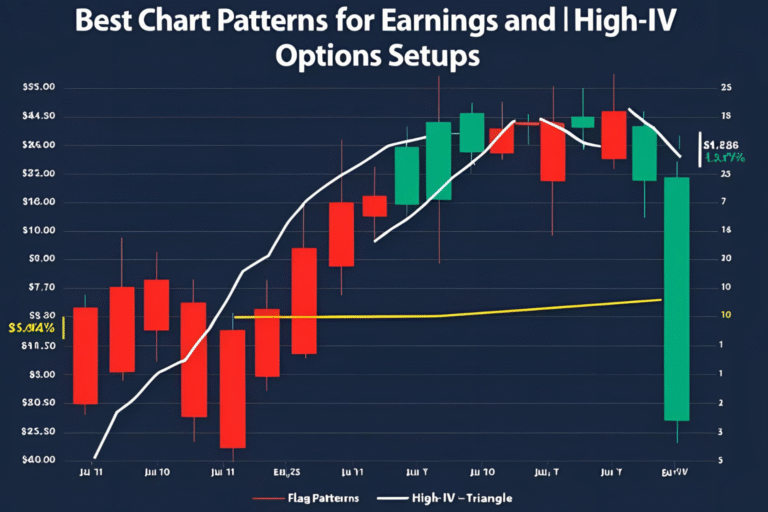

- Triangles (ascending, descending, symmetrical)

- Flags and Pennants

- Double Tops/Bottoms

- Cup and Handle

- Breakouts and Fakeouts

Unlike hindsight analysis, real-time recognition helps you act while the pattern is still in play.

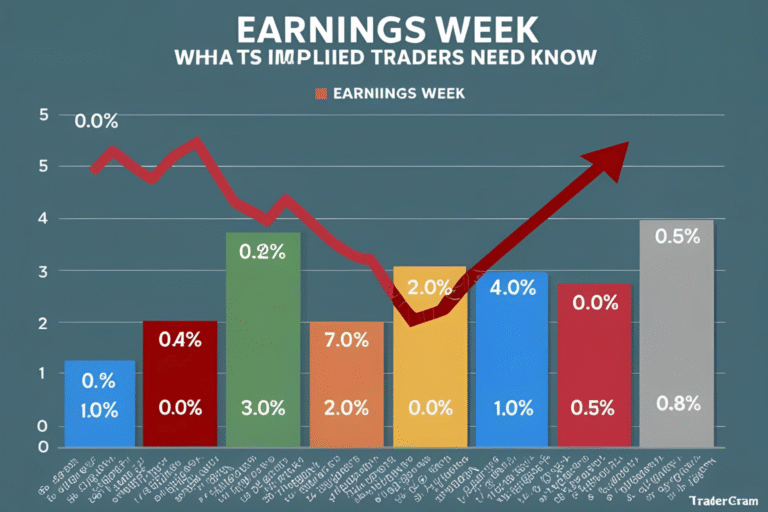

Why Real-Time Patterns Matter for Options

Options have time decay and volatility sensitivity. If you wait too long, even a correct trade idea can lose value.

Reacting in real-time allows you to:

- Get in before a breakout

- Choose the right strike price

- Capture premium before IV changes

- Exit fast when signals fail

Tools to Spot Real-Time Patterns

- TradingView – Custom alerts and auto-recognition

- Thinkorswim – Built-in scanners for chart setups

- TrendSpider or ChartStar – Pattern detection + backtest tools

- Mobile Apps – Stay updated on-the-go (e.g., TOS Mobile, Webull)

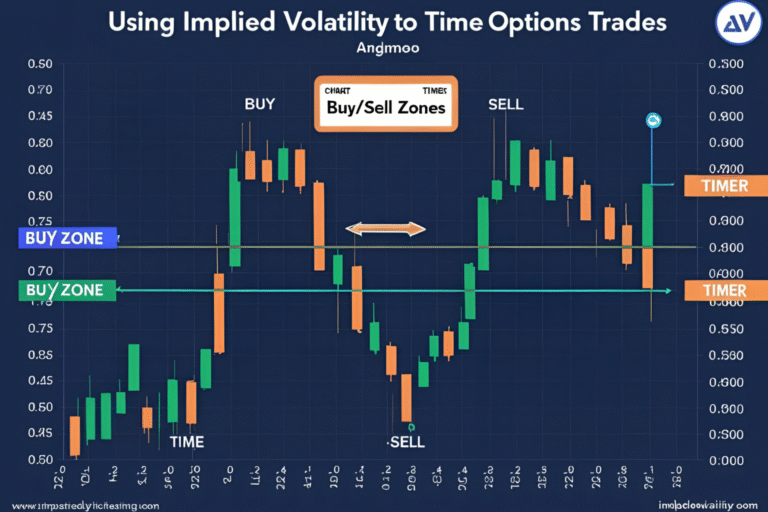

Combining Patterns with Options Signals

Use chart patterns alongside:

- Volume spikes

- Breakout candle closes

- RSI divergence

- MACD crossovers

Example: Bull flag + MACD crossover + volume = Strong call setup.

Best Practices for Real-Time Execution

- Use pre-set alerts for breakout zones

- Define entry, target, and stop before the trade

- Keep strike prices close to current price (ATM or 1 level OTM)

- Trade liquid options for tight spreads and faster fills

FAQs

1. What are real-time chart patterns?

Live-developing price structures like flags, triangles, or breakouts used to time trades.

2. How do I scan for real-time patterns?

Use charting platforms with scanners like TradingView or Thinkorswim.

3. Can chart patterns help with entry and exit timing?

Yes. They signal potential turning points, breakouts, or trend continuations.

4. Are real-time patterns more effective than indicators?

They complement indicators—use both for higher probability trades.

5. Do real-time patterns work for short-term options?

Yes. Especially useful for 0DTE, weekly, or 1–5 day expiry trades.