How to Use TradingView for Options Analysis (Step-by-Step)

While TradingView doesn’t offer direct options trading, it’s one of the most powerful tools for analyzing stocks before placing options trades. With advanced charts, custom indicators, and alert systems, TradingView is a favorite among retail and professional traders.

This guide shows you how to use TradingView for options analysis, so you can time your entries and exits with greater precision.

Why Use TradingView for Options?

Options prices move based on the underlying asset, not just volatility. Analyzing stock charts helps you:

- Confirm trends before buying calls or puts

- Identify support/resistance for strike selection

- Time breakouts for short-term strategies

- Spot chart patterns for spreads or directional bets

Step 1: Set Up Your Chart

- Choose the stock symbol (e.g., AAPL, TSLA)

- Select your timeframe (e.g., 1H, 4H, Daily)

- Use candlestick charts for better pattern clarity

- Save your layout for quick access to watchlist tickers

Step 2: Add Key Indicators

Recommended indicators for options traders:

- Relative Strength Index (RSI) – Spot overbought/oversold zones

- Moving Averages (SMA/EMA) – Identify trend direction

- MACD – Confirm trend shifts and momentum

- Volume – Validate breakout moves

- Bollinger Bands – Measure volatility for straddles and iron condors

Step 3: Identify Patterns and Price Zones

Use TradingView’s built-in drawing tools to mark:

- Support and resistance zones

- Trendlines and channels

- Triangles, flags, and wedges

- Double tops/bottoms and head & shoulders

These setups help plan your strike prices, entry levels, and risk zones.

Step 4: Set Alerts

Set alerts for:

- Price crossing support/resistance

- RSI crossing 70/30

- Moving average crossovers

- Trendline breaks

TradingView alerts can be sent via email, SMS, or app notifications—perfect for timing your trades.

Step 5: Export Insights to Your Broker

Once your analysis is complete:

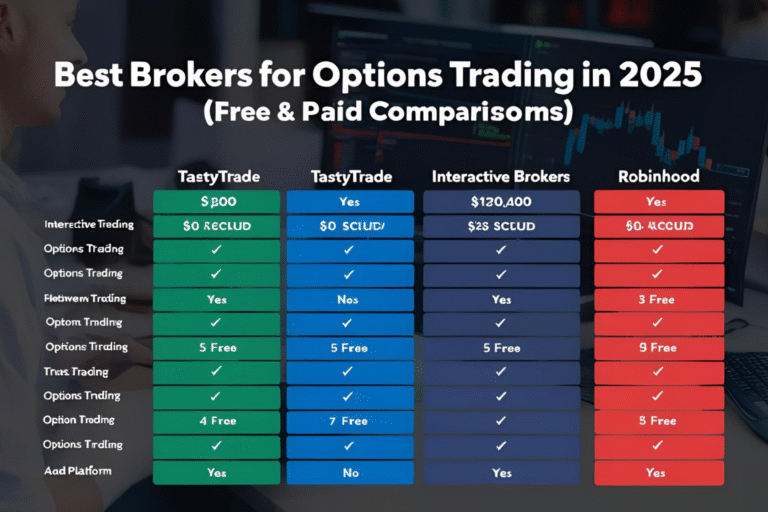

- Place your options trades with your broker (e.g., Tastytrade, Thinkorswim, IBKR)

- Use TradingView charts for ongoing monitoring and exit planning

- Adjust strikes or take profits based on real-time chart updates

FAQs

1. Can you trade options directly on TradingView?

No, TradingView is for analysis. Use your broker to place options orders.

2. What’s the best TradingView plan for options traders?

The Pro or Pro+ plans offer more indicators, alerts, and real-time data.

3. Which indicators are best for options timing?

RSI, MACD, moving averages, and Bollinger Bands are great for planning options trades.

4. Can I use TradingView for earnings plays?

Yes. Add earnings indicators and use the economic calendar for timing.

5. Is TradingView useful for short-term options?

Absolutely. Intraday timeframes (15-min, 1H) help traders plan weekly or 0DTE trades.